missouri gas tax refund

People would receive a. Refund claims must be submitted on or after July 1st but no later than September 30th following the fiscal year in which the tax was paid.

Gov Hutchinson Doesn T Plan To Lower Gas Tax Axios Nw Arkansas

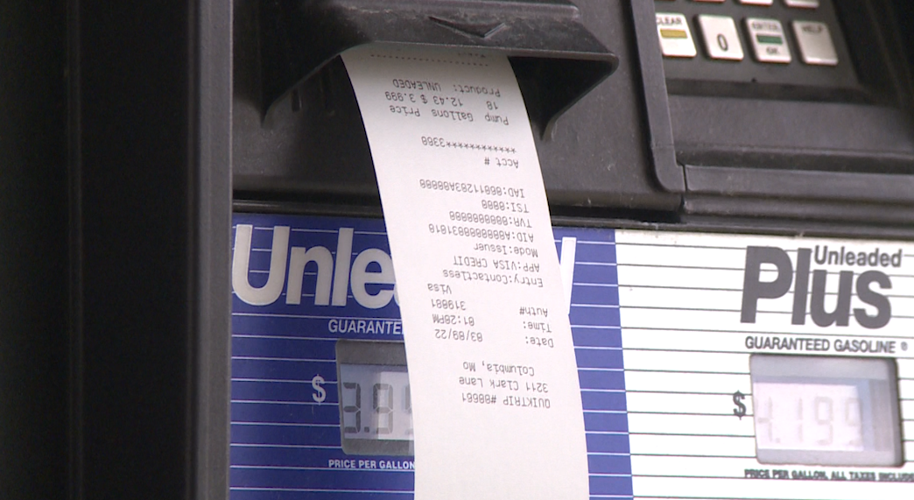

Seller number of gallons purchased and price per gallon Missouri fuel tax and sales tax if applicable as separate items.

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

. Around that time the Missouri DOR announced Missourians might be eligible for refunds of the 25 cents tax increase per gallon paid on gas purchases after Oct. 25 cents in 2022 5 cents in 2023 75 cents in 2024 10 cents in 2025 and then 125 cents in 2026 and. Tax Refund Application must be on file with the Department in order to process this claim and may be submitted at the same time as Form 4923.

I wanted to find a way to provide a solution behind it. The tax will continue to increase 25 cents a year until it hits 295 cents in 2025. Missouri resident Tammi Hilton created No MO Gas Tax app to help drivers digitize receipts and then submit them to the state for a refund.

The gas tax increase will boost Missouris gasoline. Under Ruths plan the gas tax would rise by two cents per gallon on Jan. The news of this refundable gas tax has been widely reported.

In October Missouri increased its statewide fuel tax from 17 cents per gallon to 195 cents per gallon. Vehicle weighs less than 26000 pounds. On October 1 2021 Missouris motor fuel tax rate increased to 195 cents per gallon.

News Sports Entertainment Lifestyle Opinion USA TODAY Obituaries E. Becky Ruth chair of the House Transportation Committee. Once I realized that Missouri was taxing us on something that was fully refundable it just felt like a little bit of a money grab said Hilton.

1 2021 through June 30 2022. Missouri resident Michael Cromwell said the increase in gas prices is really painful to hear and he encourages Missouri. Mike Parson in July raises the price Missouri drivers pay on gasoline by an additional 25 cents per gallon every year until 2025 for.

The tax which was signed into law by Gov. By then the total gas tax including the hikes will be 295 cents per gallon. Mike Parson on Wednesday said hes concerned about a one-time tax credit bill awaiting his approval.

For most Missouri drivers the tax is refundable. Form 4924 Motor Fuel Tax Refund Application must be on file with the Department in order to process this claim. 1 2022 and will then.

Form 4924 can be submitted at the same time as Form 4923. LOUIS In Missouri were paying more at the pump these days than we have in a long time and that includes 17cents per gallon on a gas tax. Form 4923 must be accompanied with a statement of Missouri fuel tax paid for non-highway use detailing the motor fuel purchased.

The gas tax will go up 25 cents every year for the next few years until the gas tax reaches about 30. Once fully implemented the gas tax hike could generate more than 500 million annually for state county and city roads. Individuals who drive through or in Missouri could receive a refund for the increased gas taxes paid under a new plan put forth by Rep.

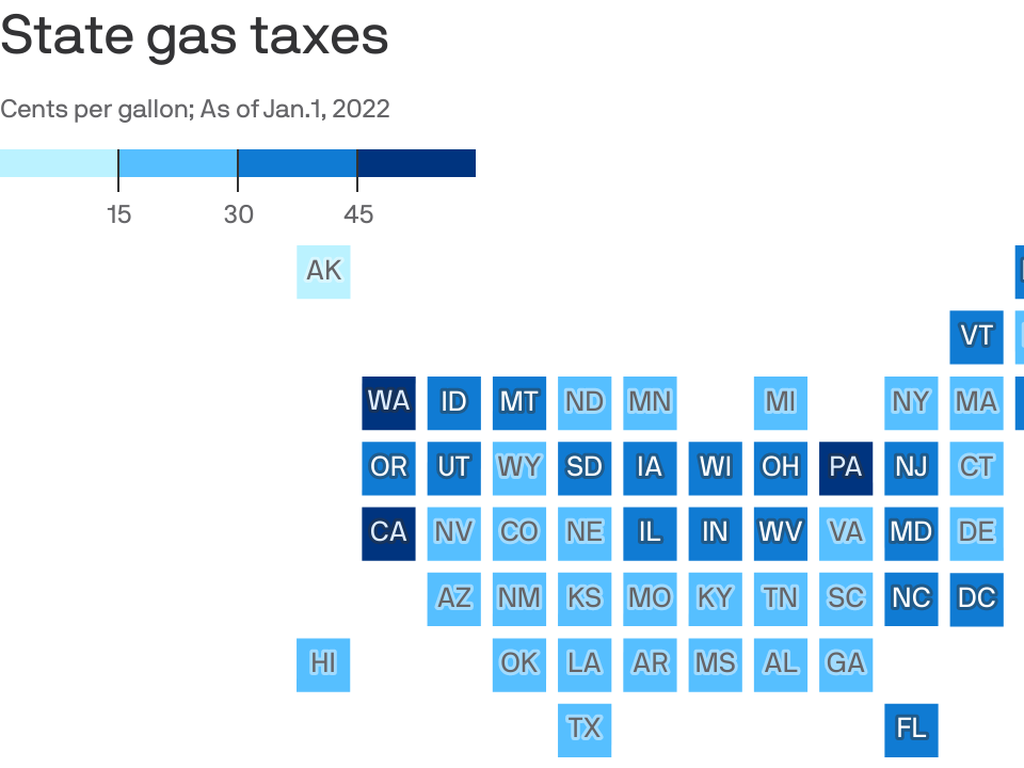

The state announced possible refunds of the 25 cents tax increase per gallon paid on gas. The tax refund only applied to the new 25 cents per gallon tax increase and not Missouris existing 17 cents per gallon gasoline tax. The bill raises Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct.

It was the first gas tax hike in 25 years but it will keep increasing by 25 cents per gallon every year until 2025 according to Missouri Department of Revenue. Vehicle for highway use. The Missouri gas tax rises to 195 cents per gallon Friday.

Make sure to save your gas receipts to get reimbursed starting July 1 2022. This bill allows purchasers of motor fuel for highway use to request a refund of the Missouri motor fuel tax increase paid annually. Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed.

Fuel bought on or after Oct. The State of Missouri currently has one of the lowest gas tax rates in the country at 17 cents per gallon. Missouris gas tax is 195 cents after the 25 cent increase in October 2021.

There is a way to get a refund on the increase. Missourians can request a refund of the Missouri motor fuel tax increase paid each year. You may be eligible to receive a refund of the 25 cents tax increase you pay on Missouri motor fuel if.

There is a way for Missourians to get a refund by submitting their receipts. Form Print Form Missouri Department of Revenue Motor Fuel Refund Claim Form Office Use Only Keyed Date Document No r FEIN r Social Security Number r Driver License Number Name City Claimant Mailing Address Phone Number Alternate State ZIP Code Fax Number - E-mail Address Avg Price Per Gal Gasoline See instructions The refund claim must be filed within one year of. Missourians will be eligible to receive their first refund on July 1 2022.

Use this form to file a refund claim for the Missouri motor fuel tax increases paid beginning October 1 2021 through June 30 2022 for motor fuel used for on road purposes. 1 until the tax hits 295 cents per gallon in July 2025. 2 days agoMissouri Gov.

Instructions for completing form. Latest Missouri gas tax plan includes rebates for drivers. Instructions for completing form.

It will go up 25 cents every year through July of 2025 when the tax will be ten cents higher than it is now at 295 cents per gallon. The legislation includes a rebate process where drivers could get a refund if they save their gas receipts and submit them to the state. It was the first time in 25 years the states gas tax increased.

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Keep Your Receipts Missourians Can Get Refunds On Gas Tax Increase State News Komu Com

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

Gas Tax Cut Again In Missouri Nextstl

Gas Tax Holiday These 17 States Are Working On Legislation To Ease Costs At The Pump Gobankingrates

Gas Tax Holiday Calls To Suspend Gas Taxes Across U S Grow As Prices Surge Ktla

Missouri Department Of Revenue Creating Refund Claim Form For Gas Tax

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

Keep Your Receipts Missourians Can Get Refunds On Gas Tax Increase State News Komu Com

Georgia Legislature Votes To Suspend Gas Tax Sends Bill To Governor

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

/cloudfront-us-east-1.images.arcpublishing.com/gray/3O53QB3CZZEADEZ56JYGMAAA6A.JPG)

Missourians Can Apply For A Gas Tax Refund Later This Year

Missouri Department Of Revenue Plans To Offer Money Back On Gas Purchases Koam

Save Your Receipts Missourians Can Apply For Refund On State Gas Tax Increase Later This Year

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

These States Have Suspended State Gas Tax Forbes Advisor